Think You Know Everything About Cell Phones? Think Again

If you are looking for information about buying a new phone, this is the right place. Sure you can always learn more, but there are good things ahead. The article here has some great tips so you can get what you need quickly.

Restart your phone every now and then to clear its memory. In this way, you will be able to get the best performance from your phone.

If your phone falls into water, never make an assumption that it can't be used any more. The first thing to try is to take out the battery and put the device into a container of rice. It will help clear out any moisture that's still sitting in the phone.

Don't watch video too much if you have an LTE or 4G signal. Most phone plans often come with a limited allowance for data each month. Videos use up a lot of data, so you may have unexpected charges. Try a new plan if you cannot stay within restrictions.

If you decide to call information on your cell phone, you don't have to pay exorbitant fees associated with that. One way is to call 800-411-FREE. After you listen to a short advertisement, you will get all the information you requested.

The data rate speed on your smartphone will decrease over time. There are some updates that minimize this problem. However, over time your gadget insurance comparison phone will not have the memory required for new updates. In just a year or two, your old phone might not be able to handle them.

If you have a smartphone, you may use it all through the day. That said, be sure to power it down from time to time. Any smartphone is like a small computer. Rebooting them often helps keep them running at top efficiency. Even by shutting it off a couple times a week, you may notice a difference.

Is your battery dying frequently? Perhaps your signal is weak. A poor signal can actually drain your battery. If you aren't going to use your phone, never place it somewhere with a weak signal, like your closet or drawer.

If you're the type of person that only wants to work with one kind of cell phone, don't think you shouldn't experiment with options that are out there. You might like one platform or device, but be open to change. There may be a lot more function out there that you don't realize.

Don't get a smartphone if you only talk on it. Many people own a smartphone, but they tend to use it for going online or checking emails. Save yourself some cash and get a regular cell phone if you just want to talk on it.

You probably won't need a case for the most modern cell phones. Today, the cell phones are generally constructed of very durable materials. While cases can help to strengthen what is already there, they may also make it difficult to actually use the phone. Learn about your phone and decide if your phone needs a case or not.

If you would like to have the latest cell phone technology, make sure you purchase something new every couple of years. Newer phones always work better for mobile websites. If you have an out of date phone, you could be missing out on the technology that best runs the newer phones.

You can play a multitude of fun games on your smartphone. Modern phones can run some really fun games. Avoid game overload on your cell phone. You can have a negative impact on your memory if you don't.

Be sure your cell phone has good protection. They may be expensive to replace or fix. A protector for the screen is especially important if you use it to view videos and other highly visual tasks. Additionally, a hard case will protect your phone against drops and dings.

Never let those cell phone cameras fool you with their zoom lens claims. The optical zoom that is on a stand-alone camera isn't what cell phones use. This is not a capability that cell phones will have. Instead of zooming, you should move closer for a better photo.

Has the time come to finally get a new cell phone to take the place of your current model? Are you nervous about searching through countless models, options, and brands? You should know have the knowledge to squash those fears.

Helpful Advice Concerning Your Ipad And You

The iPad provides a myriad of functions that make it optimal for anyone to use. The first time you use an iPad, you might have trouble understanding everything it can do for you. The following article will help you appreciate just how awesome the iPad is and what functionality is available.

Did you know that you can create folders on your iPad? To use, hold down your finger on the app you want until it moves, drag that app atop another icon, and finally, let it go. Doing this creates a folder, categorizing both apps. You can rename the folder whatever you want.

Are tired of having your iPad constantly ask you whether or not you wish to connect with detected WiFi network. You are able to get rid of this if you go into settings. Open the Wi-Fi tab of the settings menu and choose the last item in the list that appears if you don't wish to receive network prompts.

On your email, you will notice that the default only allows for two visible lines. You can change this to see more, if you so desire. Just access your Setting and the select Mail. Open the mail tab in the settings app, then navigate to Contacts > Calendar. Once there, choose the number of lines to preview using the "preview mail" option.

Click Settings, Mail, Contacts and Calendars to add Google Calendar to your iPad. You will see an option that lets you Add An Account. Tap the Other option that comes up. Tap on the CalDAV Account and then just enter the information for Google. Then you have to go from the settings app to the calendar app. You should now be set to go.

If you do not want Google used as your default search engine you can change that. You can do this by going to the settings, selecting Safari and choosing Search Engine. This lets you change to Yahoo or Bing.

Are you tired of going through the bookmark icon to visit your favorite sites? Well, you're able to keep the bookmarks bar on forever if you want to rid yourself of this problem. In Settings, open Safari and select the option to always show the bookmarks bar. Simply turn it on.

What happens if your iPad is stolen or lost? Enter Settings and then look at iCloud. Enter your Apple ID where prompted and then turn on Find My iPad. If you ever lose the device, just go to iCloud.com.

Use FaceTime for phone numbers and emails. When it's on default, FaceTime on the iPad includes the email you set up with your iPad, but it's possible to add more. If you want to include additional emails or phone numbers for FaceTime, then set them up by navigating to your iPad's settings.

You can access your running apps more quickly and easily. Double click the home button and a bar of recently-used and running apps will appear on the screen. This can keep you going when you're in a hurry.

Isn't it irritating when you encounter a hyperlink on your iPad, and you are unable to determine where it will take you? You can solve this problem on your iPad rather easily. Since hovering over a word isn't possible, you'll need to press and hold the hyperlinked word. This will reveal its URL.

iPads are great for music, but are you familiar with podcasts? You can find radio programs in varying lengths on just about any topic. When you don't want to listen to music, or wish to learn something, try a podcast instead. You are sure to find something that peaks your interest.

If you want to access your documents on your PC multiple gadget insurance or Mac, use iTunes to sync your iPad. It is no longer hard to share share files; the ability to use iTunes to share files with any computer equipment has made this indispensable. In addition, you can send your PDF documents through email and download them via a remote system.

The iPad can truly be customized to meet all of your needs. The best way to maximize the use you get out of your iPad is to learn about all the different features. Apply some or all of these great tips to ensure you are using all that your iPad has to offer.

Check Out These Fantastic Tips To Help You Use The Iphone

An iphone can be a wonderful option for combining all of your devices into one easy to use device. New users can get intimidated by the iphone pretty easily, though. Even those who have owned one for a while can gain valuable knowledge by studying the latest developments and tips. The following article will help you understand your device better.

It's important that you apply new updates to your iPhone's software and firmware whenever they're available. This ensures that you get the latest software and updates available for your phone. It also make you move pictures and documents to your computer. This way, if your phone is damaged, you will not lose everything.

If you're browsing the web through your iphone, you should know you don't have to type ".com" when you're putting in a site's address. All you have to do is type in the main address and you will be directed to the site you are looking for. This will end up saving you a ton of time.

It is possible to take a picture from your headphone cord. Begin by framing the photo. You should push the button located on your headphone cord to take the picture. This will process the photograph for you. To save it, follow the steps you would usually follow when saving a picture.

Has the perfect shot ever escaped you because you were not able to open up your camera app quickly enough? Try this easy and quick shortcut. With the screen locked, rapidly press the Home button a couple times. The camera icon is located at the bottom right hand of your screen. You tap the icon to quickly enable your camera functions.

If you are concerned with privacy, consider limiting how much you say to Siri. Nearly all voice prompts spoken to Siri are recorded and stored on an Apple server. Keep in mind that as you speak to Siri, your words may get recorded as Apple records these things to assist in speech recognition programs.

Keep the firmware updated. Not only will it help your phone function better, but it will also enable the battery to last longer, too. The firmware can be updated through the iTunes application on your computer. Or, you can connect the iphone to an Apple Computer via iCloud.

Your iphone has the ability to take a picture without you having to worry about shaking it. Just use your headphones' volume controls. Start by steadying your hand on whatever subject you wish to capture. When you are ready to snap the photograph, press the volume button on your headphone cord.

If you want to hear the clicks that you are making every time you enter a character during your texts, you can change the keyboard clicks to On in the sounds section of your phone. This way, you'll know that the phone is recognizing what you're typing, and it will cut down on typos.

If you happen to accidentally drop the iphone in water, you should not try turning it on right away. Dry the outside of your phone and allow the rest of the phone to dry overnight. If you turn on a wet phone, it can cause it to be permanently damaged.

Most people know that you can set a reminder for a specific time using the iphone, such as "Dentist at 4:30." Also, you can set reminders that are based on locations as well. An example would be to remind you of ballet practice for your daughter right after work. Many reminders types are available with an iphone.

If you wish to designate an email as "unread" on your iphone, you will need to locate the command, which is generally not visible. You need to go into the "details" menu and press the unread feature. Then, when you open your mail again, the message will appear to be unread.

The iphone is one of the most popular devices on gadgets insurance the market today. It has functions for both work and play. The tips in this article should be helpful in making any iphone user feel more experienced with their phone. Put some of these tips to use and you are sure to get more out of your iphone experience.

All You Need To Know About Your Iphone

Unless you have personal experience with a smartphone, you probably see them as confusing. The market for smartphones is packed with many devices of similar functionality. Determining which phone is better can be a challenge. Many experts think the iphone is indeed the best. This article will explain why it is the only choice.

If you get your iphone wet, simply use rice in order to dry it out. It is common for people to drop their phones in a puddle, toilet, or other wet location. If this happens, use a soft towel to dry your iphone and place it in a bowl of rice. The rice will draw the moisture from your phone overnight.

Take a picture using the volume and headphones. Steady your hands when snapping the picture, and then touch the cord's button. Using this technique will help ensure your photos are crisp and clear.

A protective screen is a useful investment for your iphone. Phones that don't have these protectors are more likely to get scratches and nicks. The hypersensitive screen can easily be damaged by dirt or even your fingers! Make sure to keep a protective screen on the phone.

A great tip to implement when using the iphone is to save the images you view directly from your browser. It is simply a matter of pressing down on the desired picture for a moment. A menu will pop up giving you an option to save.

There are a lot of insure your gadgets multimedia capabilities that you can use when you are playing with your iphone. You can enjoy videos from virtually any source on your iphone. This media mobility means you can watch movies or shows wherever you are.

Tag your email accounts to your iphone for quick accessibility to all of your messages. This will allow you to receive a notification when an email message is received and allows you to instantly view the message from your phone. You can tag one or various email accounts to your iphone.

One feature that most people use is the camera. However, after you're done take so many photos it can get pretty crazy trying to sort through them all on your phone. Organize your photos by utilizing the iPhone's album feature, and you will always know where to find your photos quickly and easily. This can help you locate a specific picture much quicker.

The iphone will show you a preview of any incoming messages right on the main lock screen. This can be a positive or a negative, depending on your preference. If it is not to your liking, there is an option to remove this facility. Choose the Settings menu, go to notifications and then touch messages. You then want to disable the Show Preview option.

If you have Siri on your iphone, but like to keep your privacy, you maybe not want to continue to use her. Siri quickly records and stores all of your important voice prompts on an internally hosted server. These files are great for advancing the technology of the main speech software, but it comes with the price of recording a great deal of your daily, spoken conversations.

Keep your iphone firmware up to date. This increases both your iPhone's functionality and the battery life. Just make sure you have iTunes on your desktop or laptop and hook up the phone to the machine. ICloud can connect to an Apple computer if you have one.

Should you be looking for an audible sound for typing, look in your Sound settings and turn on keyboard clicks. Choose to have keystroke sounds if you're accustomed to it and find it easier to type accurately when a clicking sound is associated with each key you type.

Many times suggested words can cause you to waste time when composing an email. If you do not want to receive suggestions when composing a message, just tap the screen to make the suggestion box go away. With the method, you no longer have to press the x after any word.

Now do you know why no other phone is like the iphone? Few, if any phones, rival Apple's iphone in form, function and power. The iphone has many advantages that cause it to be the best smartphone for an individual to purchase.

Some Of The Top Tips For Using An IPad

iPads are amazing and have improved many peoples' lives. To get the most out of your iPad, you should try to take some time to learn about what it can do. Keep reading to get several useful tips for making your iPad as useful as it can be.

Using your iPad to watch films, play music and play games can significantly shorten the life of the battery. One way to extend the life of your battery charge is to adjust the screen brightness. There is no reason to gadgets insurance have the screen at full brightness in any situation.

For manual lovers, you must download the manual in order to read it. Their products do not include a physical manual, but the downloadable version includes in-depth information regarding all applicable uses.

Using shortcuts makes it simpler to send messages. Try pushing the space bar two times when you are writing something. A period and then a space will be added in. This can give you the ability to send messages in volume.

Do you get annoyed by the battery charge icon on your iPad's screen? Turn it off, then! At the outset, access the Settings Menu. Go to General, then Usage. You can quickly turn on or off the battery display.

iPads are expensive, so take good care of yours. Lots of iPad owners buy screen protectors. These thin plastic sheets can give your iPad screen more protection. Clean the screen only with a soft, damp cloth. Do not use chemical products to clean your iPad.

If you have purchased an iPad for your child and are worried about them viewing mature content, change the settings so that this type of content is blocked. In settings, you can adjust the level of mature content your child can see. It is possible to ban adult content such as films.

Your iPad lets you change the brightness of your screen depending on where you are. The screen is naturally bright, but you can dim it through the brightness controls. You can find these settings by double clicking your Home button, then swiping through. Then you can change the brightness to your taste.

Many people are annoyed by the on-screen indicator listing how much charge their battery holds. Fortunately, if you're one of them, you can easily remove the indicator. To turn off, simply go into your General Settings and click Usage. There, you'll find an off button. The same procedure is required to return the icon at a later date.

Are you dissatisfied with using Google as the search engine on the iPad? You can use a different search engine if you wish. Under Settings, choose Safari, and then Search Engine. Pick another search engine from that list. You can choose from Bing, Yahoo, or Google.

The calendar function does not allow you to navigate from one day to the next by swiping. You will need to employ the navigation bar to get this done. The current day is marked in blue and should be easy to notice.

Do you want to connect your TV and iPad? You can, you just need a separately purchased adapter. You can either get a VGA adapter or a digital AV adapter from an Apple store. Both are fine.

There is a way to disable the keyboard if you do not want to use it. It's hard to type with a small keyboard on the screen. Just buy a BlueTooth keyboard for use with iPad. This allows you to type the same way that you would while using a laptop.

Have you ever wanted to take a quick screenshot before? It's easier than you might think. Press the home button and the sleep button simultaneously to grab the shot. After a flash prompt, the screenshot will be saved and you can store it where you wish. Screenshots save automatically.

Are you getting scratches on your screen? The iPad's screen is resistant to damage, however, if you are starting to notice little scratches, it is time to apply a screen protector. This not only saved the iPad from damage, but it also keeps you from developing small micro-scratches on your fingers.

People who own an iPad can tell you how wonderful it is, saving them time and providing them with entertainment. To take full advantage of its many features, though, you need the right information. Try one or all of the suggestions, tips and tricks shared in the above article to up your user's experience.

Tricks That You Could Do To Maximize Your Iphone

Lots of people want an iphone at a good price. There are quite a few things that you need to know in order to do this. Which carrier is best? What apps will make your life easier? Which model should you choose? To get a handle on some of these points, keep reading for some ideas about iphone ownership.

As soon as any new updates are available, you should immediately update your phone. This will help ensure your phone is working as fast and efficiently as possible. It also make you move pictures and documents to your computer. This way, if your phone is damaged, you will not lose everything.

Don't waste any time keying in ".com" (or any other TLD) on the end of URLs when you're browsing the Internet on your iphone. You simply need to put in the main part of the address and the browser will take you to the correct site. How much time could you save by cutting out these unnecessary elements?

Your iphone can help you get from one place to another. You could utilize the in-built map facility for finding your way around unknown areas that you are visiting. You can bookmark the map on your home screen to make it easy to access with just a tap.

Are you tired of the many notifications that come in on your iphone? There is an easy way to stop them. After you open the main "Settings" menu, touch the bar called "Notifications." Examine the apps listed in the heading and delete the ones you no longer use. As an added bonus, this should significantly improve your battery life.

If the AutoCorrect feature shows you corrections to your text, you will not have to spend the time to "X" the suggestion. Just tap somewhere else on the screen instead. This is a faster way to get rid of the AutoCorrect suggestion box.

You can take a photo using your headphone cord. Start by framing the photo you want. When you are ready, hit the cord button. This takes the picture. To save it, follow the steps you would usually follow when saving a picture.

Keep the firmware on your iphone current. Each update increases the functionality of the iphone, and improves battery life. Update firmware by uploading the latest iTunes to a computer and connecting the phone to said computer. You can also connect to an Apple computer with iCloud.

Change the ringtone of your iphone to a tune you like. You can separate yourself from everyone else and get your own customizable ringtone. Try uploading a funky, retro-classic or some other sound byte that suits your fancy. That will make people take notice.

You probably know that you can set reminders for certain times to tell you to do things. However, you can also create reminders that are location-based! You could tell the phone to remind you to go to a certain location when you leave another. You can use the iphone to remind you of any event.

You are able to take a photo with just one hand on the iphone. Frame the picture you want to take and push the raise volume button. There's no difference in the resulting picture's quality when you take it this way.

It is usually easy to navigate a web page on your iphone, but it can still take a while best gadget insurance to go back to the top on longer pages. You need not do that! If you tap the status bar near the top of the screen, you will go right back to the beginning of the page. This works for all long screens, especially one like iTunes.

You should consider purchasing the battery management app. Several different apps are available. They can inform you of what sources are taking up the most amount of battery power, and they can instruct you on what you should change to maximize it. These apps may also let you know when your battery needs to be calibrated, which keeps it healthy.

Having read this article, you should now see all of the benefits of being the owner of an iphone. The info that you've learned will allow you to use your iphone to its fullest potential.

How To Save Time And Money Shopping Online

Nowadays, it if often tough to get to physical storefronts. Due to busy schedules, hectic traffic, and insane crowds, you may constantly procrastinate making important purchases because you do not want to deal with it. This is why shopping on the Internet can come in handy. In the following paragraphs, you'll find some tips that will help you out the next time you shop online.

When you shop online, keep your eye out for coupon codes. Many retailers offer discounts and coupons for certain items. By doing an Internet search, you can often find a coupon to use at the time of your purchase. Use a major search engine, and put in your store's name and the word "coupon" to find deals. Online shopping is a great source of bargains.

Read a store's policies before you make a purchase for the first time. They include what information they collect, how it's protected, and what conditions and information you need to abide by when purchasing through them. If there are any terms you are not comfortable with, do not purchase anything without contacting the merchant. Don't purchase things from places that you don't agree with.

Don't hesitate to go to several sites and compare prices. It's really easy to get three different prices for the same item in 10 minutes, so don't hesitate to shop around. Don't, however, be tempted to purchase from a store you don't fully trust simply because of the potential deal involved. Regardless of how wonderful a price is, it makes no difference if you are not comfortable purchasing the product from the website.

Get coupons in your inbox when you sign up for your favorite store's newsletter. In many cases, stores give their absolute best deals and discounts to first time users. If you show continued interest in a brand, you can keep reaping the rewards.

When you are looking for somewhere to buy something, and absolutely none of the listings look like they come from names you know, be hesitant about putting in any personal information. If the site has a Verisign logo, you can probably trust it.

On apparel websites, find the size chart. A big challenge when it comes to clothes shopping online is the fact that it is tough to know whether things will fit. Many online clothing shops have some kind of sizing charts to help you figure out your size. This is very helpful.

Review your purchases thoroughly before you click the "buy" button, no matter where you are shopping online. It's easy to get confused while shopping online. Be sure you are getting what you want before you pay for it.

If you shop online a lot, think about registering for services that give you free shipping at particular sites. These kinds of services tend to list stores with whom they are partnered with. Some many even give you a free trial membership; that way, you can figure out if the price is worth the service. Consider trying several services in order to find the best possible one.

Keep your shopping site favorites organized with a bookmark file. These sites are going to be the ones you use on a regular basis. You should also include any coupon sites you frequent. This means you only have to click a few times in order to get trusted deals from retailers.

Establish your passwords in a serious manner. Do not use words or phrases that are simple to figure out. Online shopping accounts have your financial information, so you have to be especially careful. Make it as difficult as possible for would be thieves. Use random passwords that are comprised of different symbols, letters, and numbers.

Sign up to a retailer's newsletter if they have that option. If you shop often at a particular website, signing up for a newsletter may give you deals that aren't offer to the general public. You can buy the latest addition, get a coupon or know when the next sale is due.

There are many reasons why shopping online is advantageous. With free shipping and bargain basement prices, online shipping is often more beneficial than shopping in traditional stores. When you put this super gadget cover insurance information to good use, you'll save money on every purchase you make moving forward.

Simple Steps To Help You Better Understand Laptops

You don't want to take buying a new laptop lightly. You must think about a number of considerations to make a good choice. Fortunately, this article is full of ideas and information you can use. Read more to find some tips you can use.

To find good deals on laptops, look at home shopping networks. They offer laptops paid for in monthly installments much of the time. It can be very convenient. Just for about a hundred a month you can probably get yourself a good laptop that you've been wanting.

If you plan to use your laptop for gaming or watching DVDs or movies online, look for one that has a dedicated chip for graphics. Some laptops cannot be used to play with advanced games. Choose a quad core chip if you think you need it in your video processor.

Before you make a laptop purchase, search on the internet for discounts and coupons. There may be none to find, but you should look anyway. It really stings to pay full price for a laptop only to realize you could have paid less.

Be sure your laptop has a satisfying sound system. Some laptops don't feature sound as something that goes into their package. A bad sound system can make it difficult to hear an online video or DVD. Be sure to take a look at the sound system prior to buying a computer.

It's important to consider the size when purchasing a laptop. Laptops range in size from 13 inches to 17 inches and beyond. If your laptop is substituting a desktop, a 17 inch monitor will probably be the best choice for you. If portability is the goal, a smaller version will be ideal.

Don't get too confused when you're thinking about netbooks. They're not just smaller laptops. Netbooks are convenient lightweight devices for web surfing and checking email, but they lack the true processing power of a proper laptop. Don't get a netbook when you really need a laptop.

Look at how much memory is on your laptop. Doing this can indicate to you when it's a good time to dump programs to free up available space. Memory availability gives your laptop a boost in speed.

Lots of new laptops come without DVD drives. This is happening because many people prefer to stream media from websites like Netflix. If you like burning CDs or watching the latest DVD on your computer, you need a laptop with a DVD.

Customize your laptop for a better experience. It is easy to buy a laptop that comes with certain specs and be finished. The issue is whether it meets your needs or if it is priced right. You may pay less for customizing something gadget insurance uk because you can avoid features you don't need and get features that you really do need.

Before making a laptop purchases, make sure that you look at the various ports that will be available to you. If you have many USB devices, such as a mouse, cell phone charger, printer, or iPod, you will need to make sure you have enough USB ports. Figure out the ports you may need and make sure they are available.

Test you laptop out thoroughly during the first month you have it. There is generally a 30-day window for computer returns. Test it with anything you might be doing with the laptop, even if the chances are small that you'll be doing it really in the next month or so. You have 30 days to ensure that everything work properly.

Watch the release patterns when deciding exactly when you should buy your laptop. There are two important reasons for making this your purchase time. The first reason is that older models become cheaper, so you save money. The second reason is you can get newer features on a new model that may make it worth buying.

If you're moving your laptop to an area where the temperature drastically changes, avoid turning it on until it's at room temperature. A change in temperature can make condensation occur. Turning your system on before it's at room temperature can damage the inside components.

There's a lot you should consider before making any laptop decisions. Whether you are upgrading, or making a new purchase, you now have a feel for what to look for. Use the advice from the article to find the laptop you need.

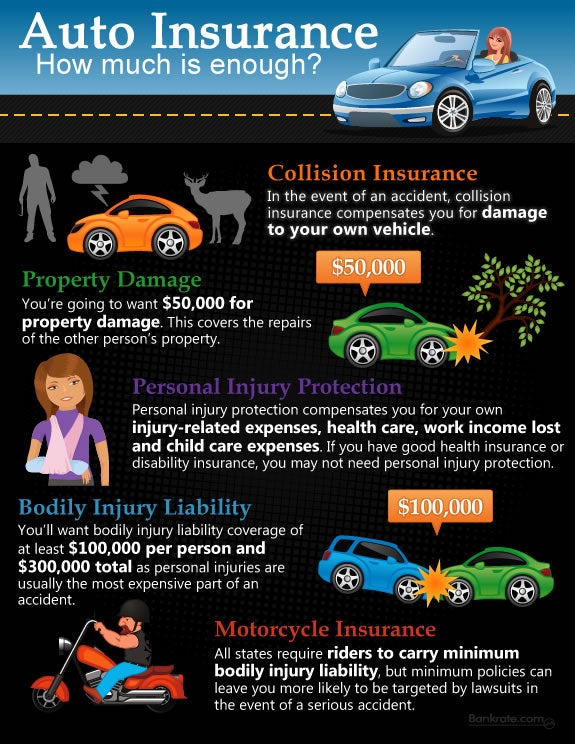

Some Insurance Companies Will Give Multi-Policy Discounts

Without the proper knowledge, shopping for car insurance has the potential to cause a great deal of stress. Although this type of insurance isn't overly complicated, it does take a certain amount of research on your part to ensure that you get quality, fair priced young drivers cheap insurance for young drivers coverage. The advice in this article will give you some ideas on how to find the right policy for your car.

Lapses in coverage are a sure way to see an increase in premiums. It is easy to let your insurance coverage lapse when you are transitioning to a new insurance carrier. Insurance companies will raise your rates if they see gaps in coverage.

What kind of vehicle you buy and drive determines a lot about the size of your insurance premiums. If you want to buy a more expensive vehicle, you are going to end up paying more for your insurance. To really cut down your premiums, choose a model that is known more for safety than for being flashy.

Commute when you can. Insurance companies will reward you for being responsible by lowering your insurance rates. One way to prove your responsibility is to lower the overall mileage that you drive on a daily basis. If you tell your agent that you have been riding the bus or carpooling, chances are they can find a discount to reduce your premium.

The person who drives the car on the car insurance policy is the only one being insured - you should always remember that. Often people will allow a buddy to use their vehicle, but if the buddy is involved in a car accident, the insurance company can deny payment of any claims. You might have to get an addition to your coverage to allow for this.

Reconsider buying add-ons for your car that you don't really need. Custom rims and a top of the line stereo system are not really necessary for your car. If ever you car is stolen or totaled, your insurance won't reimburse you for damages done to it.

Sports cars will require you to pay more to insure your vehicle. If you drive a sports car, you can expect to pay a higher policy cost. A low-profile automobile is a great choice. A larger engine also generally comes with higher insurance costs. Sports cars also cost more for the insurance, because they are stolen more often than other cars.

Keep your driving record clean. A car accident will quickly increase your insurance premium. Know your limits when driving, and avoid situations that put you in risk of an accident. If you don't see very well at night, you should avoid driving at night.

Leave more money in your pocket by choosing a higher deductible. Even though this can be risky, it can be an excellent method of saving if you can make the initiative to put some money aside, so that you can pay the deductible in case of an accident. The higher your deductible, the more you will save on your premium.

Insurance is the ultimate protection against any type of accident or disaster happening to your car. The insured individual has to pay the agreed to deductible associated with the policy in some cases, but after that the insurance company coverage kicks in.

Be aware of the different varieties of insurance coverage, and be sure your policy is complete. Liability insurance is necessary to cover you in the event you cause injury to someone else or their property. It will also be important to obtain uninsured motorist coverage, as well as coverage for things such as fire damage or harm caused by natural disasters.

If you pay several policies with one company, you may qualify for a discount. You can insure your house and all vehicles with one insurer and save a good deal of money. Ensure you are paying an affordable rate for good coverage as sometimes two sets of insurance is the better option.

By now, you will have realized that buying cheap car insurance for young drivers can be more complicated than is usually assumed. Although it requires your close attention, your effort will pay off. The best policy will give you good coverage at a reasonable price and confidence that your personal safety needs are met and your car is protected. These tips are guidelines for making the best choice in car insurance.

Getting The Most Out Of Any Online Shopping Expierence

When you wish to purchase something, it may be the Internet that you turn to to find that item. Unfortunately, although online shopping can help you save money over traditional shopping, you have to be aware of key tips. Otherwise, you will only overspend on your items. Fortunately, the below article contains an abundance of knowledge that will help you save money on your purchases.

Comparison shopping and bargain-hunting are integral parts of online shopping. You can find great prices when you shop online. Weed out sites that you don't trust right from the start. Why waste time looking at them? Even if is the lowest price on the Internet, it doesn't matter if you can't feel comfortable handing over your personal information.

Make sure you spend enough time to check out numerous online stores in order to do product comparisons. You should always compare different brands and prices if you're not set on certain brands. Find the best deal with the best shipping fees, as well. As new items are added frequently, check back to your favorite retailers often.

Look for great online deals around Wednesdays. A lot of offline shops run sales on weekends, and that's why online stores have opted for different sale days. You can do just a bit of research and get great tips in the middle of the week.

Carefully read the description before making a purchase. Just seeing a picture of something on the Internet can deceive you. It might make a certain product look the wrong size compared to reality. Reading the description will allow you to be confident in the item you are purchasing.

Try being patient instead of overpaying for expedited shipping options. You are sure to be surprised by how quickly standard shipping delivers your goods to your door. You can use the money you've said from using standard shipping can be put to more online purchases.

Look to auction and discount online vendors before buying from a big box store. Quite often, you'll see even better online deals at places like eBay and Amazon than you'll see at the traditional retailers. It may just mean that insure your gadgets you can save a lot without there being any downsides to that. Do be careful to review the website's return policies. There can be big differences depending on where you buy.

Check online for coupon codes prior to buying anything. There are several sites that are dedicated to offering online coupons. If you're unable to get a code for a site you will purchase from, search for the site's name and add "coupon code". You might be in luck.

Some online sites will give you a discount by "liking" their social media page or by signing up for emails. The process just takes a second and can lead to lots of great discounts.

Check out a variety of online shopping sites which may offer different features to help you. Different websites specialize in different types of goods. By understanding the product specializations of each online retailer, you can select the best possible one for your needs. They will allow you to sort the results by price so you can see what costs the least. Sometimes shipping will even be free.

Take any passwords that you have set up seriously. Do not pick phrases and words that will be easy for someone else to guess. Online accounts with online stores are great for accessing your credit card and sometimes more. Do not give identify thieves any assistance. Use totally random passwords with symbols, numbers and letters in them.

There are quite a few deal websites out there that give you large discounts on a daily basis. Keep in mind that some of these offers may be unrealistic. Read through the deal details with a fine tooth comb, in particular with regards to the seller's reputation, the shipping you will pay and any other restrictions.

A little time and knowledge will get you on the path to online savings. Reading the information in this article is your first step towards living a more frugal lifestyle. With the information contained here, you will be able purchase items at a discount by knowing where and when to look for the real bargains.

Every Auto Insurance Company Is Scared Of These Tips!

Make sure you are always getting the latest knowledge about auto insurance. By learning as much as possible about auto insurance, you are guaranteeing yourself the best possible policy you can get. Here are some tips to help you make better decisions about cheap young driver insurance.

Be sure to shop around prior to buying an insurance policy. Every company offers different rates depending on many different factors. By checking competitors, you will be able to locate the best deal in which you can save a lot of cash.

If you drive fewer miles per year, your insurance rates will decrease. Less time behind the wheel can mean a lower premium for you.

To ensure that your auto insurance policy is providing ample coverage, check with your agent prior to investing in items that customize your car. Your high end muffler may have cost you a fortune but if it is appraised at a low value, then you are at a net loss if your car gets stolen.

It is a common misconception that the cost of auto insurance automatically drops as the driver reaches 25 years of age. If you have a good driver record, your premiums will go down as you age, even if you are still under 25.

The kind of vehicle you decide on will be a huge factor in the cost of insurance. Insurance companies charge higher premiums for that high end luxury model you love so much. If you want to save money on insurance, choose a safe, modest vehicle.

Carpooling and public transportation are great ways to lower your insurance costs. Reducing your mileage is a good way to demonstrate to your insurance company that you are a responsible individual. Letting your agent know that you frequently use mass transit or ride in carpools, can be a great way to lower your insurance costs.

Whenever possible only carry one family member per car. This should help keep the premiums low. You can get a better premium rate if you have just one person listed as the registered driver for a particular vehicle.

Take the time to get quotes from different car insurance companies. Rates vary wildly from one company to the next. To make sure that you are getting the best deal, get quotes at least once a year. You should be sure that you are getting the right coverage when researching insurance companies.

Trade in your sports car for something more insurance friendly. Insurance companies charge higher rates for insuring a sports car. Choose a smaller car with a less flashy profile. Those with high performance engines will be expensive to cover because they are involved in more accidents. Sports cars are also more likely to be stolen, so they cost more to insure.

Maintaining a spotless driving record is easily the soundest advice you will ever get for car insurance. A car accident will raise your rates quicker than almost anything else. Drive defensively and know your limits. Stay out of situations in which you have a higher chance of an accident. If you have trouble seeing in the dark, avoid driving at night.

It's possible you could remove a few of the coverage items from your insurance policy. Collision insurance might be an unneeded extra if you drive an older vehicle, for instance. Cancel that expense and you could save a significant amount of cash. Comprehensive and liability coverage are some other things you may want to consider cutting.

The history of your driving record will play a huge role in the price of your cheap young driver insurance. However, when your infractions expire, your rates will go back down. Make sure you get a new quote after your old infractions expire to take advantage of your lower rates.

When you see that other companies are offering lower rates, talk to your own insurance agent about it before you decide to look into the other company. A repeat customer is valuable in business, and your current agent is likely to cut his or her own quotes to match others and keep you on board.

Hopefully, this article has helped you gain knowledge on deciding the right auto insurance. How well you make decisions depends on how much knowledge you have. Share these tips with those you care about.

Get Helpful Tips About Desktop Computers That Are Simple To Understand

If you're like most, a desktop will come in mighty handy for productivity. Perhaps you enjoy making home videos, or you enjoy maintaining long distance relationships over social media. Regardless of why you plan to make the purchase, the tips below will be a big help.

Keep an eye out of anyone wanting to give away a desktop computer. Many people are looking to shift their computing to tablets and laptops, so you can buy their desktop computer quite inexpensively. These computers usually work fine too, but run them through their paces to be sure before you buy.

Buy a desktop that has just features you need. Some people purchase models with features they will never use at a price that is more than they can afford. Think about necessary features so you can have the best value.

Before deciding on a computer, check several reliable tech websites for reviews. You can easily get overwhelmed with your options when looking for a computer. If you look for quality reviews written by technical professionals, you will be able to get the one that will perform as you expect it to.

Look for a warranty when buying a new desktop computer. This is just for if the software or something else were to mess up and make the computer unusable. If you've got a warranty and some goes wrong, you'll simply be able to bring the desktop back again to the store for fixing. Or they may offer you a new computer of the same model to fix the issue.

If you have PC programs but want a Mac desktop, you can invest in Parallels for Mac. It's the perfect software to use when you need to use your Mac to run a PC system event. This way, you can run any PC program that you have! You will also need to make a separate purchase of the operating system for the PC to go along with it.

Many computer manufacturers now limit the amount of information in a manual that come with their computers, preferring instead to the put the info on the Internet. This means you should take a look at any information online about your computer, and make sure that what you read is helpful enough for your needs.

You'll want to ensure that the software you receive with your computer is legal. You need the CD to prevent legal trouble and so you can receive updates later.

Do not miss out on your dream computer because you're waiting for the price to drop. Some folks are constantly watching for deals. However, they don't do anything, as they think they can get a good deal soon. Usually there is not much of a price difference between good gadget insurance deals, so you should act quickly when you find a great one.

Don't consider a warranty when buying used. Hardly any manufacturers are willing to do warranty transfers. If you decide on buying a used computer, do so with the knowledge that there will be no warranty.

Be really smart when shopping for a budget computer. Yes, computers can be very pricey. Knowing what your needs are will make computer shopping much simpler. Compare hardware as well as price. You should look for a balance.

In the past, people bought a combination deal that included a monitor, computer and printer together. Avoid doing this. You can just use a cheap monitor or small flat-screen TV instead. Bear in mind that the mouse and keyboard will still work if you have them.

Ergonomically correct keyboards are essential for desktops. This will help you to avoid pain while you work for long periods on your computer. The keyboards are comfortable to use and causes a minimal amount of stress to your wrists and hands.

Before doing anything, think about what your computer will be used for. Write down how you use a computer and the tasks that you commonly perform on your computer. Create a detailed list so that you do not leave anything out.

The plethora of information that is needed to buy a computer is amazing. It is easy if you know more about it. Using the tips here will make shopping a breeze.

Shopping Online Is A Breeze With These Tips

One of the greatest conveniences of the Internet is shopping online. However, even though this is fairly simple to do, you have to be sure you're aware of what goes into it first. Use this advice to ensure you are successful with online shopping.

Read the terms and conditions as well as the privacy policy on any new store you wish to shop at. These will tell you what information is collected and how it is protected. Additionally, you will learn about the conditions and rules you must follow to use the website. If you are unsure of anything, contact them with questions before making a purchase. If you can't agree with the policies, then not making the purchase is your solution.

Compare products by browsing through many sites. If you don't have your heart set on a certain brand, compare the different products. Choose one that has all of the important features that you need and is priced fairly. When you visit your preferred online stores frequently, you will never miss current sales.

Don't provide any online site with a social security number. No shopping websites should ever ask for this extremely personal piece of information. When they ask you for this, they are trying to scam you. Leave this site, and find one that has a better reputation.

If this is going to be your first purchase from this seller, check out other customer reviews before buying. These comments can let you know what type of experience to expect for a particular retailer. Avoid vendors with a significant amount of low ratings.

Register for newsletters from your favorite stores to get the very best coupons. Stores frequently offer the best deals to people who have recently registered on their site. You can also expect to get discounts and special offers on a fairly regular basis, so signing up is definitely worth it.

You may like fast delivery, but it costs significantly more, so try just using standard shipping. It may work out anyway. Standard shipping is not as bad as it seems. This option will also help you save a lot of money.

Prior to entering any personal information on an online store's website, check out the site's URL. If it starts with "https" it is okay to proceed as this means your information is being safely encrypted. If it doesn't have this, the your information isn't secure.

Search discount and auction sites prior to making purchases from retail stores. Sites like Amazon and eBay tend to have better prices than traditional retailers. You can save a lot without giving up much. Make sure you're okay with their return policies though. This can vary quite a bit depending on where you're shopping.

Websites will list multi gadget insurance product information to help a potential buyer make a better decision. On these sites you can find customer reviews about the product.

If you're not familiar with auctions online, know about the way disputes are worked out prior to making any purchases. Sometimes the auction site itself works with users to resolve disputes. However, there are websites that merely provide a venue for sellers and buyers to connect, leaving you on your own in the case of a dispute.

Search for coupons before purchasing anything. There are several sites that are dedicated to offering online coupons. If you aren't able to identify a code for something you want, search for the site name with the keywords "coupon code" added. There may be something to find out there.

Some online sites will give you a discount by "liking" their social media page or by signing up for emails. It does not take long to become a fan of their Facebook page or sign up for their newsletter. Plus, you'll probably get good deals.

Try using sites that compare prices, such as Froogle. Simply enter in the basic information about your desired product, then let the site do the hard work. Just remember that these services won't check every single website online. These websites can be excellent places to begin, but if the prices they provide do not match your expectations, continue searching.

It's easy to buy things over the Internet. Online shopping has many advantages when compared to stores. But you need to know a bit about the process before you jump in. This article should help.

You Invest In A Car So Invest In Auto Insurance

The price of insurance is based on several factors, some of which can be changed, and some which cannot. Asking for a higher deductible can lower your premium. Read this article to find the best ways to get the most out of your young driver insurance for less money.

Look around and compare prices before choosing which insurance policy to purchase. Every insurance company has their own way of calculating your risk level and premium rates. By checking out multiple competitors, you can find the best deal and save yourself a lot of money.

Before you buy any "extras" for you car, have a conversation with your agent to see if this would change your young driver insurance premiums. Your high end muffler may have cost you a fortune but if it is appraised at a low value, then you are at a net loss if your car gets stolen.

When purchasing auto insurance, be sure to get quotes from a number of different companies. The rates are not the same for all insurers. You should shop you auto insurance at least once a year to guarantee you are receiving the best rates. Being sure that the coverage is the same between the quotes that you are comparing.

Pay attention to the insured driver on your policy. Many drivers lend their car out to a friend, only to find that the friend's accident is not covered because they were not listed on the driver's policy. If you want a policy that covers additional drivers, be prepared to pay more.

Avoid paying for your car insurance with a monthly bill. Insurance agents add three to five dollars to monthly bills. This can be expensive over time. If you have tons of other monthly bills, it can quickly become a large burden. IF you have less payments you are better off.

When purchasing car insurance, add property damage liability to your policy. That will ensure that damage caused by your car in an accident is covered. Almost every state requires this coverage. Many add to this a coverage for "uninsured drivers" who lack this liability insurance. It can be a real financial lifesaver if you get into a serious accident with lots of damage.

Increase your deductibles to cut down on your expenses. If you do not have the money on hand to pay your deductible, this can be risky. However, by diligently saving enough to meet this amount, you can save lots of money on your premium by electing to raise it. Your premium will cost less if your deductible is higher.

You can save a lot of money with the right coverage if something happens. Choosing a reputable company and thorough coverage will leave you with only the cost of the deductible to deal with in such an occasion.

Get your auto insurance agent to give you a listing of every discount the company offers. Go through the list of discounts to be sure you get every one that applies so you save money.

Don't buy your teenage children their own cars or insurance plans. Have the teenager use a family car instead. Adding them as a secondary driver to your current insurance plan is cheaper than giving them their own car insurance policy. Some insurance even offer discounts for students that get good grades.

Investigate which discounts are open to you and ensure you capitalize on all of them. You'd be surprised how much you'll save if you claim discounts.

When people buy a new car insurance policy, they often forget to check if it has a clause to payout in the event of an accident caused by an uninsured driver. This can really increase the price you pay, so think twice. Getting into an accident with an uninsured driver when you are not covered can end up costing you a lot of money or time in court.

You may have noticed that you can totally change the price of your car insurance. Things that you are able to influence include the location of your residence, the amount of driving you do and especially your legal driving record itself. Keep this article in mind to keep yourself educated about ways to reduce your insurance costs.

IPad Tips That Will Make Your Day

An iPad can help you do a lot of different things. You've probably already delved deep into it, but might need a little advice to expand your ability as a user. There is so much it can do. Continue reading.

Monitor your iPad app spending. It's very common for iPad users to run up large bills buying music and apps. Keep close tabs on this, or you will surely regret it!

You can change your setting so that you are no longer asked whether or not you are interested in joining a Wi-Fi network. The Ask/Join networks feature can be used to facilitate this. By choosing that option, you will never again be bothered by the invitations.

Your password information can be protected by setting it to erase if someone enters it incorrectly a certain number of times. If someone can't figure out the password after 10 tries, all the data on your phone will be erased.

You view two lines by default when you see new emails. You may want to have more text available to preview. Under Settings, tap on Mail. Then choose Contacts, go to Calender, then pick the Preview option to increase the number of lines.

If you need to mute the audio on the iPad, do the following. Just press and hold the "volume down" key for two seconds. This is easier than having to keep readjusting the volume. If you want the volume to revert back to the original level, just hold down the button again.

Your FaceTime phone numbers and emails should be set up. You can add as many gadget insurance comparison emails as you wish. Just add them in the Settings app.

Do you ever find yourself browsing the web and wondering where a word that is hyperlinked will take you? The solution is really quite simple. Since you can't hover over words like on a regular computer, you may touch and hold that word. That will show you the underlying URL.

An iPad is an amazing musical tool, but are you aware of the podcasts? Podcasts are radio programs that may last only a few minutes or could run several hours, and they cover all kinds of subjects. If you crave something a little more stimulating during your morning commute, try a podcast. You are likely to find a subject that fascinates you.

You can copy and paste text on your iPad. All you have to do is tap on your text and then copy it. Press again to highlight the text, and then press Copy. Tap again, hold and choose paste and your copied text will appear.

You might never use all of the apps on your iPad. Many unwanted apps cannot be deleted. Create a folder for these apps and place it toward the bottom of your home screen. This will allow you to focus on what you do use much more.

Every setting doesn't necessitate the same lighting, so be sure to change it up. The brightness can be turned down by pressing the home button two times and then choosing the proper setting. Doing so lets you change the brightness for the ambiance.

Notifications can be controlled. If tons of applications are on your device, you probably deal with lots of notifications. To manage all of these alerts, just go to Notifications, which is located in Settings. This lets you choose which apps can alert you and which cannot. That keeps alerts to only the most important notifications.

Tap on the home button twice to maneuver between apps. Simply tap the app that you'd like to switch to. Do this again if you want to get back to where you originally were.

Have you had the desire to take a screenshot? It's actually really quite simple. Press home and then press the sleep/wake button. You'll see a flash, and there's your screen shot. The shot is saved already, so that's it!

If your iPad's volume buttons aren't responding, you must check Settings, General, and Sounds. Be sure that Change With Buttons has been selected so everything works as you want. You may use the slider as well.

Because you are now better able to utilize your iPad, begin today. You will discover that iPad has a limitless amount of uses. Before long it will become indispensable in your life and you'll wonder how you ever lived without it.

Gaining Traction In The Auto Insurance Market

Auto insurance isn't just for your car. Auto insurance not only protects you, but it protects other people as well. When choosing a policy, make sure you pick one that covers all of your needs. The advice in this article is designed to show you how to get the most coverage from your cheapest car insurance for young drivers policy for the least amount of money.

Look around and compare prices before choosing which insurance policy to purchase. Every insurance company will use a different formula to give you a price, usually based on your driving history and answers to questions. You will find the policy that is most affordable and best suited to you by checking into policies from several different companies.

Letting your auto insurance coverage lapse will raise your insurance rates. You can create gaps in coverage easily by moving from one insurance carrier or policy to another one. Insurance companies will use the gaps as an excuse to raise your rates.

Your monthly insurance cost is determined by the kind of truck or car that you buy. You might have high class taste for luxury vehicles, but your insurance premiums are going to reflect that. To get the most for your money, go with something a little more reserved and safe.

You must have the state legal minimums; however, there are many optional protections that are available. You will have a higher premium with these, but they may be worth it. Obtaining uninsured motorist coverage makes certain you will be compensated if you are involved in an accident with a driver who has not purchased insurance or if you are hit by someone who hits your car and flees the scene.

Commute when you can. Insurance companies like when their policy holders show responsibility, keeping your mileage low is something they really appreciate. By telling your agent you take public transportation, you could be in line for a discount that will reduce your premium.

When selecting your insurance policy, be sure to get quotes from several different agencies. It may surprise you just how much insurance rates can differ from one insurance company to the next. To keep your premiums as low as possible, be sure to obtain new quotes at least once per year. Just be careful to make sure that the quotes are offering the same levels of insurance when reviewing.

Keeping a clean driving record is the best cheap car insurance for young drivers tip you can get. Nothing increases your premiums like getting into an accident. Drive defensively and know your limits. Stay out of situations in which you have a higher chance of an accident. Do not drink and drive and stay home if the weather is bad.

Choose a higher deductible, and you will pay less for your insurance. This move may be risky as you will have to pay more in the event of an accident, but your monthly insurance rates will be cheaper. The higher your deductible, the more you will save on your premium.

You should evaluate each item covered in your car insurance young drivers to see if it might be worth dropping from your policy. If your automobile is not worth much, consider dropping collision insurance from your insurance plan. This move may save you a significant amount every month. Liability coverage has a required minimum, but if you previously had a high amount, you may want to lower it somewhat.

Your auto insurance agent will have a list of any discounts offered by their company. Go through the list to make sure you are getting as many discounts as possible to maximize the amount of money you save.

If you want to switch to a different auto insurance company, make sure you have a new policy in place before you cancel the one you have. Auto accidents can happen at any time, so make sure you always have insurance.

Don't buy your teenage children their own cars or insurance plans. You can save money by sharing a family car. If you add them to your current insurance plan, it will be a lot cheaper. You may even be able to get a discount on your insurance if your teenager is a good student.

Using what you've learned here, take a second look at your existing insurance policy. You may discover that you haven't had adequate coverage, or that you are being overcharged.

Laptop Tips You Will Not Find Elsewhere

When you have to demonstrate a website for your client, bringing him to a home office isn't always feasible. If you have lectures to go to, taking notes by hand often won't capture all of the important details. This article will help you know how to look for a new laptop in a quick, efficient manner.

If you want a great price on a laptop, check out some of the websites for TV shopping networks to find a good deal. You may be able to make installment payments without worrying about a credit check. For as little as $100 a month, you'll find that you are able to be able to get that laptop you want.

You must be thinking of a budget for yourself when purchasing a laptop. Your needs may dictate what kind of budget you will set. Do you want a PC or a Mac? Macs give cutting edge technology in graphics, making them ideal for people working in an environment rich in graphics.

Consider the work you'll be using your laptop for. This is a big aspect to think about when looking to buy. If you are a casual web surfer, you won't need the same type of complex system as a graphics designer. Once you assess what you plan to do with the laptop, you will have a better feel for what you should spend.

Use a cooling pad to extend the life of your computer. People don't often realize that many laptops end up no longer working because they were allowed to get too hot. Getting a good cooling pad which usually cost no more than 20 dollars or so and extend the life of your device.

Try to get more RAM before you buy it. It may not be necessary now, but could help you out later. At this time though, upgrading isn't going to cost you as much as a new computer will. Think about this before you decide on making a purchase.

Try several different types of laptop computers before deciding which one to buy. You might not be looking at ergonomics as well as hard and fast technology. Poor ergonomics, however, can impact your health and your comfort.

When searching for a laptop, consider its battery life. Even if you're only going to be using it at home, having to constantly charge your battery gets very annoying. You should be able to use your battery power for at least four hours.

Think about a protection plan if you're going to be carrying your laptop everywhere. A protection plan will pay for damages caused by accidentally dropping your laptop. Read the details of coverage carefully before you buy.

Shop smart when it is time for a new laptop. Visit retail establishments and check out their laptops. While you are there, try several to see which one feels more comfortable. After finding a laptop you like, search online for special deals.

Avoid buying a computer just because of the name. Famous makers do have some great products, but they come at a high price. Know about the hardware specs of every machine, so you can understand whether the big name brand is working to give you a superior experience. Great laptops can often be found through companies that are lesser known.

If you find your laptop budget comes up short by one or two hundred dollars, you may not have to compromise on features if you're willing to try a refurbished unit. The price student gadget insurance can look good, and if there's a good warranty, there isn't much risk. Many don't cause their owners issues, so many great models are within reach.

The graphics chip is a crucial component of your computer. If you want to use your laptop for basic things, you should be fine with a graphics chip that's integrated. You will get better performance for games and videos by using a dedicated chip for graphics. It's important to note that laptops specifically made for gaming often have some of the best chips inside of them.

You can do practically anything anywhere, from showing clients projects to making videos and contracts. You can take notes at a meeting or a conference. You will be able to get on your new laptop computer, any time and any place, thanks to the information you found in this article.

Steps For Making Sure Your Auto Insurance Coverage Is Adequate

It is essential that every driver has adequate auto insurance. Finding a plan that suits your needs can be quite overwhelming. Below are a number of tips to assist you in this process so that you can protect yourself with auto insurance.

Know the limits of your insurance coverage before you install valuable aftermarket parts on your automobile. Insurance usually won't cover the cost of aftermarket parts, but will add to the value of the vehicle.

As a money-wise step when car shopping, take the cost of insurance coverage into account. Your insurance agent should know which cars have low premiums. You can make a better decision in buying a new or used car based off this information. Buying a car with a higher safety rating can result in substantial savings for your auto insurance.

The majority of people think car insurance young drivers rates for young drivers will drastically decrease as soon as they turn twenty-five. The truth is they slowly drop after the age of 18.

If you need additional coverage, look into optional insurance packages. You will pay more if you choose these add-ons, but, in many cases, they are worth the money. There are many uninsured motorists on the road, and uninsured motorist protection will protect you if you get into in an accident with one who is found to be at fault.

Opt out of unnecessary coverage with your auto insurance. If your vehicle is older and less valuable and your policy includes collision insurance, it may not be worthwhile to keep paying for it. By getting rid of coverage you do not need, you can lower the amount of your monthly insurance bill. You can also consider dropping comprehensive and liability coverage.

Insurances companies, as a rule, are all different. Check with several other insurance companies if you are given a quote you don't like, since they will probably offer different prices.

Some people find it difficult to decide on how much car insurance they need. If you are relatively well off, you should buy more liability coverage. In the event of an at-fault accident, you could be sued by the other party to cover their medical expenses. If your bodily injury liability is not adequate to cover these, then your personal assets are now exposed. It is worth the money to have your car properly covered by the insurance company.

Consider paying your entire premium up front. Insurance companies commonly charge fees for splitting your premium into monthly installments. Since you know how much it will cost you to renew your policy, you can start saving up money to make one annual payment at renewal time and save money on those fees.

Always research the company that you are purchasing auto insurance from before signing a contract. Buying car insurance isn't always about finding the cheapest rate. As with other things, "you can't get something for nothing" applies here. Those that quote unbelievably low rates can be the stingiest when delivering on claims and are often hard to deal with.

If you want a lower premium then you should think about paying a higher deductible. The size of your deductible has a large influence on the amount of your premium. Of course, a higher deductible means that you are responsible for what the insurance company doesn't pay. Creating a separate fund for unexpected emergencies is always advisable.

Many insurance companies provide discounts for the elderly. It can be nice to get a possible 10% discount on your insurance policy.

Choosing a higher deductible will lower your insurance premiums. Although you will have to pay more money up front if you get into an accident, you will still have coverage for big expenses. If your car is not worth a lot of money, selecting a high deductible is a good choice.

Most car insurance companies are willing to give big discounts to households that are all covered by the same company. Keeping every vehicle on the same policy can lead to significant savings on your monthly premiums.

Don't get caught without auto insurance today! You will be saved from a pile of financial trouble by having car insurance. The tips you've read in this article will guide you as you look for the best insurance plan for your needs.

Tips To Help You Use Your Iphone

Do you want some new iphone applications but do not know how to find and download them? You have come to the right place. The information below will share lots of cool ideas for getting the most out of your iphone!

When you know how to use volume controls for picture taking, you can take the picture with your headphone cord. As you prepare to take the picture, steady your hand, then quickly depress the button located on the headphone cord. By doing this, you do not shake the iphone, which will ensure your shot is clear.

Location-based reminders can be set by using Siri. Now you don't have to say " Siri, remind me at five to call work." You now say "Siri, please remind me when I arrive home to phone work." Your phone will detect where you are and tell you about whatever reminder you set. Using this can make it possible to set reminders even when you are not sure when you will be home.

Do you get annoyed by receiving so many notifications on your iphone? There is a way you can shut them off. First, go to settings, and then go to notifications. Review the apps under this heading. You can remove any that you wish to. As a bonus, this will increase battery life.

There are different ways that you can improve how fast your messages are created. If you want to avoid suggestions from the dictionary, tap the screen anywhere to ignore it. You do not even have to tap the small "x" that is found at the word's end.

You can take screenshots with your iphone. Whenever you're on a screen you want to snap, hold down the Sleep and Home buttons simultaneously. The screen should then turn white and you'll know the picture was saved.

The Safari browser on your iphone is capable of almost everything your standard, full-size computer browser is capable of--including saving images you find online. If you locate a photo that you want to hang onto while browsing, just tap the image and hold. The context menu that pops up will let you save the picture directly to your phone's Camera Roll. You can also email the image.

Always remember to update your OS anytime a new version comes out. Apple iPhones have now almost become as intricate as computers, so there exists sporadic patches to repair functionality issues, bugs and security holes. Doing this is even more important if you use your phone to transmit any kind of personal data.

Make sure to regularly update your compare gadget insurance firmware. Not only will it extend the life of the battery, but it will make your phone more functional. Connect your phone to the computer and upload iTunes. Or, you can take advantage of iCloud's ability to the phone to an Apple computer.

Turn keyboard clicks On by going to your Sound Settings if you like hearing the little clicks every time you press a character. This helps you avoid mistakes typing.

Don't waste time using suggested words when typing on an iphone. When you are typing and a suggested word pops up, ignore the 'x' and just tap on your iPhone's screen anywhere. That will remove the suggestion box. You do not have to tap the x on every word.

Interruptions many frequently bother you while you are using your iphone. You may want to finish what you are doing before tending to the notice. Or you can eliminate the notification. When the pop-up bar appears at the top of your screen, simply swipe it away.

Your iphone makes surfing the web easy; however, scrolling back to the beginning of a page can be a bit cumbersome. There's no need to! If you tap the status bar near the top of the screen, you will go right back to the beginning of the page. This works for all long screens, especially one like iTunes.

To close out of your email, simply cancel it if you want to save the content. The device will inquire as to whether or not you want your unfinished writing to be stored as a draft. This will allow you to access the email and finish at a later time.

Since you've read this article, you know all you need to know about the newest iphone features. Start downloading and installing more useful apps on your iphone. Use what you have learned here, and turn your phone into much more.

Determining Your Best Auto Insurance Options Using Accurate Tips

Auto insurance policies cover more than your car. However, it can also protect you and those involved. While choosing a policy, it is important to make sure that you have enough coverage. These suggestions are going to help you gain a lot more from your insurance policy.